Saving is difficult, especially for high school students who don’t have jobs or who spend their money going out and buying things. While it is fun to spend money, high school is the last stop before adulthood where finances do matter.

Many schools don’t teach their students how to budget or save for the future, Whether it’s for a home or a college dorm. Some schools send their students out blindly. While some places do have classes for this, they are almost always an elective and not mandatory.

The first part of saving money is to find income, which could be from getting a job or having an allowance. Sometimes the first part can be hard. Many student-athletes, club students, and almost all students have too much on their plates.

Von Mitchell, DHS Personal Finance teacher, advises, “Put some money away that you get from holidays. As long as you’re living at home, put some money away and don’t just be a consumer.”

Income: Many jobs have a starting age of 15 – 16, which is the age of most freshmen and sophomores.

Some popular jobs that could work for high schoolers are servers, lifeguards, cashiers, pet sitters, yard workers, babysitters, and tutors. Getting a job in high school has many benefits: not only does it allow students to gain savings, but it also gives them work experience, which is huge for when they are applying for jobs in the future. Many companies/corporations look for people with some work experience as their next candidates.

Spending: After gaining a job, the next step is to cut out unnecessary expenses. Warren Buffet, one of the best-known investors in the world, said “Do not save what is left after spending. Spend what is left after saving.” Big ways to save money can be making lunch instead of buying it, avoiding impulse buys, skipping out on small activities, and only focusing on necessities.

“I don’t really save money so when I get the money I just spend it right away,” senior Alicia Manzenariz said. “We usually go to Monstrose or Grand Junction, and go bowling or go to the mall.”

Make a plan: Saving starts with a plan. Whether it’s deciding how much to put in every paycheck or setting a money goal, having a plan is a good start to saving.

Senior Velma Bailey decided to start saving to have money for college. “I want to have 20 to 30 thousand saved,” Bailey said.

In Delta High School, many of the students have jobs and saving plans including Leo McKenna, a junior who works as a mechanical vehicle technician. This job includes performing basic care and maintenance on cars including changing oil, checking fluid levels, rotating tires, and repairing or replacing worn car parts. Mckenna’s job allows him to save and put money toward his goal.

“I want to have at least 10 thousand dollars saved by the end of the year,” McKenna said. After meeting his goal, McKenna plans to spend his money and start saving again.

Everyone has a different goal, whether planning on saving or not. The idea of saving money while being in school isn’t impossible and is a small thing that can help students prepare for their futures.

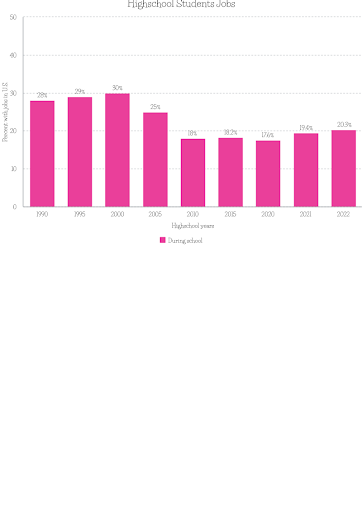

Data from Statisia.com